I quote here the Press Release 7 June 2016, and also look back at last year.

“European Business Keen to do More in China if Reforms are Implemented”

Press Release

The European Chamber’s annual Business Confidence Survey reports that while its member companies are increasingly pessimistic and perceive China’s reform progress to have stalled, a clear majority would likely increase their investment if they were given greater market access.

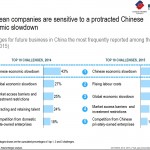

The survey finds that Beijing’s failure so far to deliver on promises that foreign-invested enterprises will enjoy a more open, competitive market has fostered mounting pessimism: a significant 41% of European companies are now re-evaluating their China operations and planning to cut costs, including through headcount reduction. Although 47% also report that they plan to expand their operations in China, this represents a thirty-nine point decrease from 2013, when an overwhelming 86% of European companies were intending to do so. However, a clear majority of European business would likely increase their investment in China in the event of market access barriers being removed.

China’s economic slowdown continues to pose a significant challenge to both Chinese and European companies. However, European business is suffering more acutely from its effects due to an increasingly challenging business environment, coupled with a playing field that is perpetually tilted in favour of domestic enterprises. The survey’s key findings speak to a deepening disillusionment in China’s reform agenda:

- 56% of respondents report that doing business in China has become more difficult, a five-point increase from 2015.

- 57% perceive that foreign companies are treated unfavourably compared to their domestic counterparts.

- 58% of respondents state that the recent tightening of Internet controls and access restrictions has a negative impact on their business, a 17-point jump from 2015.

- 70% of respondents do not feel more welcome in China than they did 10 years ago.

- 55% would likely increase their investment China if afforded greater access.

It is also noteworthy that European companies’ willingness to invest in R&D in China has dropped from 85% in 2015, to 72% in 2016, indicating that the Chinese Government’s ongoing efforts to attract innovation are not having the desired effect.

The successful completion of the EU-China Comprehensive Agreement on Investment is seen to be integral to improving the business environment and reducing market access barriers. European Chamber President Jörg Wuttke said, “European companies now need a roadmap. This will give them with the confidence they need to commit more to China’s future development in these economically challenging times.”

-

-

“Despite slowing and L-shaped growth, China’s economy could be powered for another two or three decades of high-quality expansion by measures including further pruning overcapacity, supply side transformation and strengthening innovation,” said Roland Berger CEO Charles-Édouard Bouée. “Addressing these tasks and the challenges highlighted by the Business Confidence Survey will ensure both that all of this growth ultimately takes place and that European business is able to make a major contribution toward attaining it.”

About the European Union Chamber of Commerce in China

The European Union Chamber of Commerce in China (European Chamber) was founded in 2000 by 51 member companies that shared a goal of establishing a common voice for the various business sectors of the European Union and European businesses operating in China.

I have been a very active member for many years (Public Procurement Working Group), but this year I left as I refocus on other areas.

Interesting is to see the evolution year by year. See here some flash back on the 2015 Confidence Survey as well as the Position Paper 2015/2016.

The slides show the key issues and concerns of the European business world, not much different from what Amcham and others conclude. I would say, nothing much has improved, on the contrary.

I always feel the situation is actually more somber as the surveys do not take into consideration the many smaller companies that went under and disappeared in silence, due to their difficulties.