China Daily recently did a web survey on how the U.S. are looked at here. Some interesting results, all in order of hits:

– favorite websites: Google – Yahoo – Hotmail – Youtube

– most powerful biz person: Bill Gates – Warren Buffett – Alan Greenspan

– president with biggest contribution to bilateral relations: Bill Clinton (47%) – Richard Nixon (37.9%) – George W Bush (9%!)

– non biz celebrities with highest commercial value: Michael Jordan – Bill Clinton (!) – Michael Phelps

Not mentioned is that quite a number of Chinese think the financial meltdown was intentionally caused by the U.S. to “harm China”. I guess those are mainly the ill-informed “Patriotic Cybernationalists”, a dangerous breed here. They should have a round table discussion with their American counterparts who genuinely believe bad China is going to attack the USA.

Whatever misunderstandings between the two countries, China is now the major owner of U.S. debt instruments. It’s like the expression “riding the tiger”: you can’t get off. Unless China decides to terminate the USA – not by a big bomb. Simply by dumping all the dollars (and losing their reserves in the process). They are an odd couple: bickering but can’t do without the other.

Biz, Economy and More

More serious stuff on business in China

Corruption in China and fraud on Wall Street

The South China Morning Post just published an interesting overview of some of the major corruption cases in China and who in the higher government went down with it. One notorious offender is (former, obviously) secretary general of Shanghai, Chen Liangyu. Happens I knew him rather well, played tennis with him, lobbied for my projects and certainly got some help. I had a high opinion of him as he … never asked for bribes and seemed to do a good job. He didn’t have to beg, as he had apparently other huge “reserves” to tap into.

Corruption unfortunately remains here a very serious problem. But when you see the scale of rot in Wall Street, hey guys, China is not so bad, right?!

For Bernard Madoff to run a huge ponzi fraud scheme, losses being estimated at US$ 50 billion, all under the clever and watchful eye of the so-called Wall Street geniuses: whaw.

Free market without supervision? Just imagine how many people he ruined.

For Madoff, good he ain’t over here – no danger of dying of cancer. No need to wait that long, see what happened to the guy with his ant breeding.

The recession and what to do/think

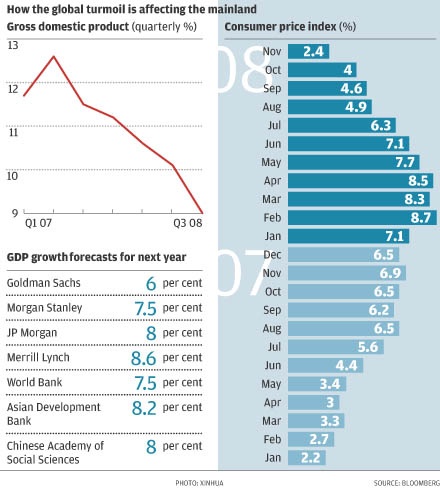

I am not going to report anymore on the increasingly bad news on the economy. (Auto bailout?). I wrote enough and if you want to know more, well, read like me the International Herald Tribune and/or the South China Morning Post (online). See here their latest chart (12 Dec 08) that gives you a taste.

So, what to do?

We are scaling down. Actually we eliminated several jobs in our company since about a year as we are focusing on some clients only. And I really want to organize my papers in my office and start writing something. Also, with a bit of sadness, I decided not to renew the (expensive) AMCHAM membership. Same for those Belgian chambers (whatever their names) over there in Belgium (they offer little or nothing for us here in Beijing).

So, I’ll stick with the European Chamber where I stay very active, and the Benelux Chamber.

I will also have to take care of my health. With the horrendous pollution here and the stress, my back problem has returned with a vengeance. I have to get back to “normal” next year and that includes running long distances. We Flemish people are stubborn.

Furthermore, I am not that optimistic on how the officials here are reacting to the “social problems and unrest”. Clampdown on the media continues and will get worse as those people are getting scared of their own shadow. So, much of the rot in the system will continue to sit there. The recent hoopla and media blackout about a “certain detained CCTV person” is one of the many cases. One more reason to retreat to my little corner and let the storm pass over.

The only good news is – finally – Maggie’s, with the best little hot dog stand in Beijing (and much much more), reopened after closing more than a half year ago. If you don’t know the stories behind, then obviously you have no clue about Beijing.

It’s like when I tell people where I stay: “go to the Gongti Strip, I’m across the road from Babyface”. If I get a blank stare, I just roll my eyes.

Jump! Jump!

Back in the1929 Financial Crash it was said that some Wall Street Stockbrokers and Bankers JUMPED from their office windows and committed suicide when confronted with the news of their firms and clients financial ruin. Many people were said to almost feel a little sorry for them.

In 2008 the attitude has changed somewhat:

(no, it’s not me standing there in the picture!)

Recession: China shows the figures

No further comments needed here! As said…

The Ministry of Commerce announced that actual foreign direct investment (FDI) in China fell 36.52% year-on-year to US$5.32 billion in November.

The General Administration of Customs announced that China’s imports and exports totalled US$190 billion in November, down 9% y-o-y: China’s exports reached US$115 billion, down 2.2% y-o-y; China’s imports reached US$78.5 billion, down 17.9% y-o-y. This is the first time both imports and exports saw negative growth for the month in the past seven years.