Read here, no further explanations needed! Belgian chocolate, Belgian beer: is GOOD for your health!

PRESS COMMUNIQUE BY THE EMBASSY OF BELGIUM IN CHINA

BELGIAN CHOCOLATE OF SUPERIOR QUALITY – FOOD SAFETY GUARANTEED

NO IMPORT RESTRICTIONS ON BELGIAN CHOCOLATE TO CHINA

The Belgian authorities and the Federation of the Belgian Chocolate Industry would like to reassure Chinese customers that consumption of Belgian chocolate – a top quality export product of Belgium widely appreciated all over the world – is absolutely safe. Imports of Belgian chocolate into China have always respected Chinese health and consumer safety regulations.

According to a recent report by China’s General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) one package (24 kg) of yellow edible ink, used to decorate chocolate cakes, has been refused import clearance by the Chinese customs authorities. This product does not contain any chocolate.

Some Chinese and Western media misunderstood this report and mistakenly claimed that there was a quality issue with Belgian chocolate. This is absolutely not the case and the Chinese authorities do not at all restrict imports of Belgian chocolate into China.

As winter has started, and with the Chinese New Year’s celebrations looming, the Belgian authorities and the Federation of the Belgian Chocolate Industry invite every Chinese citizen to continue to taste and savour Belgian chocolate in all its different forms.

Biz, Economy and More

More serious stuff on business in China

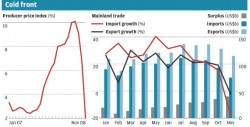

The recession tsunami hitting China

Why are “economists” surprised? Of course things are getting worse, also in China that has more advantages to face the turmoil. But if it does not change some of its habits, we could face a stormy 2009. See here what those “experts” are stunned by – chart from 11 December, SCMP. And they all forgot the negative impact of the Olympics on the order books.

Comments from some well-known dissidents (edited for obvious reasons):

China must make its political reform match its outstanding economic achievements and root out the corruption and collusion between officials and entrepreneurs throughout the country.

But it’s impossible for the Party to transfer its power to the people willingly. More massive unrest will take place soon.

Corruption, social unrest and other injustices on the mainland have been aggravated by the lack of checks and balances because of the halt to political reform.

All the social elites and media have refused to take social responsibility and have kept silent about all the injustices. They just care about whether the government will offer them opportunities for career development.

Unfortunately, a lot of that is true. Social unrest is increasing, nothing strange in view of the recession. As usual, ordinary workers are the immediate victims and “worker unions” are nowhere to be seen when needed.

Hundreds of striking migrant workers picketed an electronics factory in Shanghai for a third day on 10 December in a feud stemming from allegations of layoffs and unpaid bonuses.

The workers claim Shanghai Yixin Industry owes them months of unpaid benefits for working in high temperatures during the summer and overtime for working night shifts.

“The company’s gangsters attacked and beat us using pickaxes,” said one protester, who showed a photograph of the alleged weapons on his mobile phone. “The police arrested five people yesterday and one person this morning. They beat up more than 10 people on Monday night, and some are still in hospital.”

Several protesters showed cuts and bruises on their arms, shoulders and faces. All reported by SCMP.

As usual, factory representatives, police and local authorities tell a different story. All too typical, including the use of “gangsters” (Henan Province has lots of them, see Tom’s story).

Those are the challenges. If authorities do not address the unlawful situations, do not protect workers’ rights, do not root out corruption at local official levels, the comments of the dissidents will prove to be more than true.

But for China, this is not all that new and shocking as some might think. See here what our friend Jasper Becker wrote:

Layoffs trigger rise in protests

China has been hit by one of the worst outbreaks of industrial unrest since the reform policy started in 1979.

Chinese sources said the number of protests had been growing all year as more than half the state-run industries had been unable to sell their products or pay wages and pensions.

In the worst-off industrial cities in Heilongjiang province, such as Shuangyashan, Jixi, Jiamusi and Mudanjiang, up to 80 per cent of the workforce has been laid off. Many were surviving on handouts of as little as 70 yuan a month.

Even in cities like Tianjin, Shanghai and Beijing, workers and pensioners had staged sit-ins in factories or in front of local party headquarters demanding unpaid wages and payments, they said.

‘There were strikes and sit-ins taking place in all the cities I visited, often with the tacit support of local cadres,’ said Trini Leung, a researcher from the University of Hong Kong who spent three months traveling through Manchuria to study the labor crisis.

On October 22, hundreds of unpaid miners in Shuangyashan staged a sit-in in front of the local party headquarters, watched by police, to press their demands. Sources said that before this year’s Spring Festival 40,000 people took to the streets.

Many of the miners, made redundant by the collapse of the provincial coal mining industry, were reported to be unable to afford winter clothing, while in orphanages staff were unable to make do with an allowance of 40 yuan per child. In Shenyang, the capital of Liaoning province, 350,000 workers were reported to have been laid off, many without pay.

In Tianjin, which has attracted far more outside investment, state-run industries had been shedding workers all year. As output plunged, many enterprises, including the famed Flying Pigeon Bicycle Factory, had halted production for a part of each month.

The unemployment rate in Tianjin’s industrial workforce is about 40 per cent.

Sources said that the Flying Pigeon factory had dismissed 7,000 of its 20,000 workers, while another factory producing glass fibre had released half its 3,000 workers.

In cities across the country as many as 50 million workers have been laid off or are underemployed.

In Beijing, many factory employees work only a few days a month and no longer receive the all-important production bonuses.

Date of the above SCMP article: 28 November 1996. History repeats itself. China did not burn down. Somehow, inspires optimism.

The Internet and other data in China: unreliable

If you try to know how many Chinese are “Internet users”, welcome to the fuzzy world of Chinese data. Today reading 3 newspapers I got 3 figures, all “official”:

203 or 230 or 253 million – with 10.7 million bloggers (excluding myself).

It’s the same like trying to know how many people live in Beijing Municipality.

The municipality covers 16,400 sq km, with only 6,000 sq km “exploitable”. According to local authorities we are approaching the “saturation limit” of 18 million – we are now at 16.3 million. Take that as usual with a grin. Nobody explains if yes and how the huge migrant population (4 to 5 million?) or/and non-hukou holders are included. Of course now that the Olympic venues are built and the real estate frenzy is cooling, many construction workers will probably have left, or will. All depends what is to be included – some use the yardstick of “visitors staying longer than 6 months”.

My best guess is still: close to 20 million grand total.

Recession: good and evil

If some thought (as happens) that I was overreacting with the “Recession”, it’s now clear we haven’t seen the end of the tunnel yet. People are losing their jobs everywhere.

The Obama team looks impressive, except that some of the members are actually part of the “brains” who invented all those great financing tools (= weapons of mass destruction, they weren’t in Iraq, they were at home). The team will have a very hard time to get through this mess. But if they don’t succeed, who could?

Of course, some stayed blind and probably will remain so. Here’s a nice quote from a certain senator Phil Gramm, from 2001:

“Some people look at subprime lending and see evil. I look at subprime lending and I see the American dream in action”.

So far for the wise words. American dream, yeah. For some crooks to enrich themselves and then ask for money from the government to “save the economy”.

China handles it a bit different. The leader of a bogus scheme to breed ants who conned investors out of US$ 439 million was recently executed. Let’s send the Chinese to Wall Street.

As noted earlier, the signs are on the wall since some time, also for China that depends (too much) on exports:

– global demand for container ships has fallen by nearly 50% this year

– China: 34% drop for new ship orders in China (globally down by 27%)

– Shanghai container traffic target for 2008: down 5%

– shipping cost per container Shanghai to Europe down from US$ 1000 (January) to now 200.

Those are the little things that tell you what to expect.

Business Confidence Survey 25/11/08

As chairman of one of the working groups in the European Chamber (EUCCC) I assisted at the Press Conference in the Kerry Center Hotel on 25 November.

The Survey was carried out in partnership with the consultant company Roland Berger.

The Survey was presented by Mr. Wu Qi (Roland Berger) and Joerg Wuttke, President of the EUCCC. As the Conference and Survey received quite a lot of coverage I only report here some of the findings about European companies in China that I found interesting.

– most prefer WOFE and stick to tie 1 and 2 cities

– smaller companies overall seem to do better, maybe because they operate in niche markets

– SME tend to be run more by expats

– most newcomers are SME

– issues of concern are protectionism and economic nationalism; environmental laws tougher for foreign firms

– many doing development (and less research) to adapt products to the local market

– little enthusiasm for M&A

– the outlook for the first half of 2009: difficult; second half “hopefully better”; lack of “predictability” on how the stimulus plan will work out

– real estate sector a concern as it affects many other sectors including white goods

– the previous concerns for the pressure of increasing costs for shipping, transport, etc. now less important.