The “d” word is still shunned. But what is the definition? Depends – as usual. Some say, it is a long and severe recession characterized by high unemployment. Others define it based on a 10% fall in output, something that did not happen since the 1930s.

But one thing is clear: it is going to take time and will be painful, as the IMF people already warn (“The worst is yet to come”).

Securitization (in the USA) holds 1.5 trillion US$ of subprime and alt-A loans, 400 billion are delinquent. More are to become delinquent and more foreclosures (of homes) are on the way.

CitiGroup announces staff cuts of over 50,000 worldwide on top of 23,000 earlier layoffs. And so on: financial job losses worldwide are expected to climb from the now 170,000 to over 350,000 by next year – 20% of the total jobs.

It would be naïve to expect China to escape from the domino effect. With exports going down and international companies cutting budgets and people, what can you expect? South East Asia with Japan will also suffer as they supply many of the components used in China’s exports. Logical.

China is not that hungry for a trade surplus. The value-added factor in exports is said to be just 16%, with the other countries like Japan taking a big share. Not to forget the profit companies like Wal-Mart make on their exports from here.

So, China has to focus more on its own needs and market.

China has announced a 4 trillion boost program and a further 1 trillion is already in the pipeline. I totally disagree with Laurence Brahm and others who look at the China infrastructure projects as wasted money, like the Japanese bridges to nowhere. They don’t understand the much needed improvement we need in rail transport, urban transport, water treatment and so on. In recent years, the Ministry of Railways could only satisfy 30% of the demand for passenger and goods transport. Traffic jams in the big cities can only be solved by more public transportation. The electric power network badly needs a better transmission grid to interconnect the separate grids. Everybody knows that. Waste? You must be kidding.

The U.S. better follow China. As Mary Peters, current U.S. transportation secretary said: “The US is one of the few countries in the world to make the majority of its transportation investments without first conducting any kind of economic analysis to determine whether those investments will have any practical benefits for commuters or shippers. The results are telling”.

Indeed, a run-down network of highways and bridges and poor railways and outdated airports. And so much more. Come and learn from China?

Biz, Economy and More

More serious stuff on business in China

Recession – 15 Nov 08

Slowly the obfuscation on the recession gives way to reality: with the EU (euro zone), Germany, USA, Japan now admitting they are in recession the words slowdown, downturn, deceleration and others are fading.

Dark clouds are everywhere. Just to mention a few samples: BT (UK) to eliminate 10,000 jobs; London’s financial district is to shed over 60,000 jobs in 2009; in Macao 20,000 Hong Kong construction workers to lose jobs with at least 11,000 worker cuts in the Sands casino expansion project. It’s not only in the USA. Credit remains scarce and like in the UK business can’t get money to pay their staff. Banks just remain frozen in many markets.

Price levels and/or consumption of crude oil, cupper, iron ore, electric power and commodities are falling in key industrial countries. Travel & tourism will suffer leading to further unemployment.

Property markets in China are uneasy though the banking system here is more insulated from the housing market than in the USA and UK. Only 19% of total Chinese bank loans are in the real estate sector compared to 50% in the USA and loans are overall more “solid”. But the real estate sector still affects about 10% of China’s GDP. So, still reason to worry. China’s economic stimulus plan will help in part but expect a slowdown anyway in cement, iron, steel etc.

And the stock market? Never been my favorite here, I consider it a casino and it’s disconnected (fortunately) from the real economy. But with so many Chinese speculators losing tons of money, not a nice situation. The “good” thing is, it started to fall since quite some time as the Chinese top banks had clearly warned. When I look at the Shanghai stock exchange performance over time, I am not that optimistic. At least going back to levels of 2002-2002 seems an acceptable theory.

While Chinese are said to save too much (gross national saving rate is at 56%) people here have reason to safeguard themselves with the still poor social safety nets. Changing that will not be easy. The US has to learn to save more, to switch from asset- to income-based saving. Not good overall to increase consumer spending… In the USA during the fifties up to eighties, saving rate was 9%. In the past years it went down to 1%. Some calculate that in a modestly optimistic scenario, consumer spending in 2009 might be down by 400 billion US$. Just imagine the domino effect.

At least China is helping the USA again, as the central People’s Bank of China would buy US$50 billion worth of US government bonds to take its total to US$750 billion by last month. China is by far the biggest holder of US government bonds, surpassing Japan’s US$595 billion holdings and accounting for 35.4% of the total held by foreign central banks. If China does not support the dollar and switches to euro, it would simply bankrupt the USA – and China would lose a lot too.

US dollar is king, kind of

Recession: Chaoyang District looks ahead

The Chinese government is well aware of the world-wide recession and is acting. Maybe not all decisions are perfect but at least they move faster and in a more pragmatic manner than most Western countries. The 4 trillion Yuan package announced a couple of days ago is overall good as it will address urgent needs to improve infrastructure (railways & other) and many other sectors. Admitted, some of the projects are not entirely new but still, it’s a lot that will give a boost to the local industry – and some foreign companies too.

Of course, many are still in denial (the term “recession” is mostly avoided). Too bad. We are still going downhill, the USA market looks worse and worse, foreclosures up, consumer buying down.

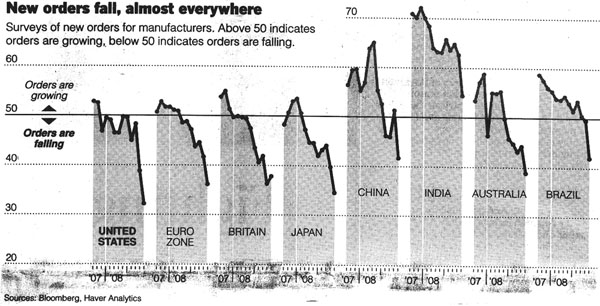

See above chart from IHT dated 8 November. Once that filters down the industry, expect even more lay-offs and problems in “the factory of the world”. So, something has to be done.

On 12 November I was invited for a morning meeting and lunch with the Beijing Chaoyang District to review several options to boost the economy in the district that is one of the main sources of GDP. It houses the CBD, Complex 798, the entertainment and shopping areas of Sanlitun and the Olympic Green, among many others. One of the main topics was how to make the best use of the immense Olympic Green area.

Gilbert with the Chaoyang District Governor Mr. Cheng Lianyuan and Chaoyang Vice Mayor Ms. Gou Zhong Wen.

Chinese Green Card for Gilbert

Press Release

7 November 2008

Gilbert after getting his Card at the Beijing Public Security Building

On 6 November 2008 Gilbert finally picked up his Chinese Green Card, after delays due to the Olympics, the October National Holidays and a busy schedule.

He feels honored and happy to be now, more officially, “Half Beijinger” (“Yi Ban Bei Jing Ren”)

It is officially called “Permanent Residence Permit for Foreigners in the PRC” and is difficult to obtain. The approval procedure is lengthy and complicated, and applicants must satisfy many conditions.

The Card has several advantages, such as:

• For foreigners above 18 years it is valid for 10 years. Because the Ministry of Public Security issues the card, it is valid throughout China.

• Easy entry and exit: With a passport and the Card one can go in and out of China freely. So the Card saves the time and expenses needed to get a visa. It can also be used separately as a legal certificate to stay in Beijing.

• Employment: Foreign expats without resident permits are not allowed by law to work in China without approval. But there is no regulation limiting foreigners with Chinese Green Cards about employment. Foreign expats with the Card should be allowed to work and treated according to all Chinese labor laws.

• Rent: Foreign expats with a Green Card have the same rights in civil and commercial affairs as Chinese citizens. They can rent or lease houses without examination or approval from the public security bureau.

• With a the Card, one can buy commercial housing or even economic-class houses in the city they reside in, if they meet the requirement.

In his social circle of Belgians and Rotarians in China, Gilbert is not yet aware of anybody else holding the Green Card.

For more information about Gilbert: http://www.strategy4china.com/briefgvk.pdf