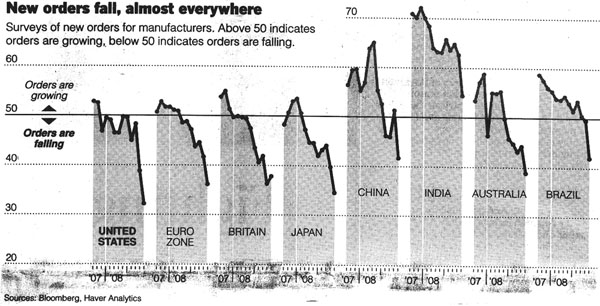

Slowly the obfuscation on the recession gives way to reality: with the EU (euro zone), Germany, USA, Japan now admitting they are in recession the words slowdown, downturn, deceleration and others are fading.

Dark clouds are everywhere. Just to mention a few samples: BT (UK) to eliminate 10,000 jobs; London’s financial district is to shed over 60,000 jobs in 2009; in Macao 20,000 Hong Kong construction workers to lose jobs with at least 11,000 worker cuts in the Sands casino expansion project. It’s not only in the USA. Credit remains scarce and like in the UK business can’t get money to pay their staff. Banks just remain frozen in many markets.

Price levels and/or consumption of crude oil, cupper, iron ore, electric power and commodities are falling in key industrial countries. Travel & tourism will suffer leading to further unemployment.

Property markets in China are uneasy though the banking system here is more insulated from the housing market than in the USA and UK. Only 19% of total Chinese bank loans are in the real estate sector compared to 50% in the USA and loans are overall more “solid”. But the real estate sector still affects about 10% of China’s GDP. So, still reason to worry. China’s economic stimulus plan will help in part but expect a slowdown anyway in cement, iron, steel etc.

And the stock market? Never been my favorite here, I consider it a casino and it’s disconnected (fortunately) from the real economy. But with so many Chinese speculators losing tons of money, not a nice situation. The “good” thing is, it started to fall since quite some time as the Chinese top banks had clearly warned. When I look at the Shanghai stock exchange performance over time, I am not that optimistic. At least going back to levels of 2002-2002 seems an acceptable theory.

While Chinese are said to save too much (gross national saving rate is at 56%) people here have reason to safeguard themselves with the still poor social safety nets. Changing that will not be easy. The US has to learn to save more, to switch from asset- to income-based saving. Not good overall to increase consumer spending… In the USA during the fifties up to eighties, saving rate was 9%. In the past years it went down to 1%. Some calculate that in a modestly optimistic scenario, consumer spending in 2009 might be down by 400 billion US$. Just imagine the domino effect.

At least China is helping the USA again, as the central People’s Bank of China would buy US$50 billion worth of US government bonds to take its total to US$750 billion by last month. China is by far the biggest holder of US government bonds, surpassing Japan’s US$595 billion holdings and accounting for 35.4% of the total held by foreign central banks. If China does not support the dollar and switches to euro, it would simply bankrupt the USA – and China would lose a lot too.