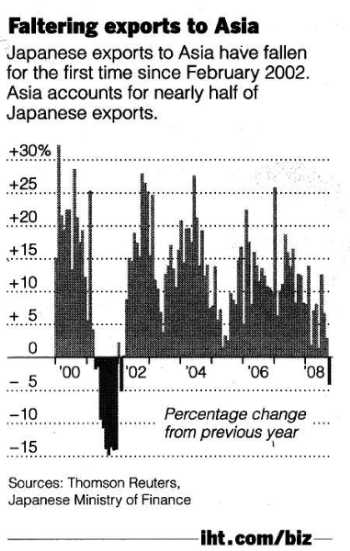

As said earlier, Japan and other Asian countries will suffer. See the chart (IHT 21 Nov 08) about faltering Japanese exports. Again, I refer to what happened in 2001-2002, in other words – way more to go down as this recession is much worse than that one.

For China, exports have been too important. It is said exports counted at one point for 50% of GDP and would be now at 40%. Not sure that is correct, looks a bit too high for me. But that half of the Foreign Exchange reserves are from the trade surplus makes sense. Switching from an export oriented economy to a consumption-driven society won’t be easy. According to Standard Chartered, 35% of demand in 2007 was generated by the government, not households. But if one considers personal income is growing at 15% per year and China tries to improve the social security network – convincing consumers to save less – there is room for increased consumption. If GDP growth does not fall well below 8%. In the meantime, who cares if it is the government spending?

Recession

Detroit: help or not?

Tough question. If the Big 3 (well, not so big anymore) fail, the ripple effect of potential job losses would be staggering. They directly employ 250,000, then some 3 million are either in the supply chain or the distribution network. Scary of course, but it doesn’t mean all would be without a job forever. I agree dumping money in that black hole is a waste, something in the U.S. car industry is rotten after years of mismanagement, shoddy products, bad strategies for R&D and new models. Again, the “free market”, where GM Chief Wagoner gets rewarded US$ 14.4 million in 2007 for taking all the wrong decisions. Hello? The same inept management style like in the financial sector. Bailout for those? Kidding, right? Best is to let them go into bankruptcy, restructure, eliminate the sick companies. And ask Rick Wagoner to step down, and to return all his income of the past years (they call that “claw-backs”), and maybe let Steve Jobs take over to streamline the companies. So they make better cars than those gas guzzlers that shout for more oil drilling in the wrong places. iCar anybody? Made in China? OK, maybe not yet…

General Motors just announced that it is ending its sponsorship deal with the world’s most recognisable athlete, Tiger Woods. Maybe Tiger can explore a deal with a Chinese car company. He’ll get (fake) golf clubs extra, free of charge.

“End of the market that never was”

Book review by Charles Zhu – Beijing Today, 14 November 2008

The website of “Beijing Today” is now officially a dangerous “attack website”! Went there anyway and had to correct several mistakes in the article. The site is still pretty lousy.

I won’t buy the book but the review is interesting. Read for yourself.

Good to refresh the memory of some here:

Paulson 20 July: “It’s a safe banking system, a sound banking system. Our regulators are on top of it. This is a manageable situation”.

Or better, in May: “The worst is likely behind us. There is no doubt that things feel better today, by a lot, than they did in March”. “Looking forward, I expect that financial markets will be driven less by the recent turmoil and more by broader economic conditions and, specifically, by the recovery of the housing sector”.

Yeah, those silly people like Soros and Buffett.

Took some time for the Bush incompetents to “admit” there were some problems. Maybe the regulators were on holiday?

People today are fairly impressed by the foresight of George Soros in his book “The New Paradigms for the Financial Markets”, published by PublicAffairs. As early as last May he wrote, “We are in the midst of a financial crisis the likes of which we haven’t seen since the Great Depression.” Soros said that the financial system, as it currently operates “is built on false premises”. Unfortunately, we have an idea of market fundamentalism, which is now the dominant ideology, holding that markets are self-correcting. All five big investment banks – Bear Stearns, Merrill Lynch, Lehman Brothers, Goldman Sachs and Morgan Stanley – disappeared or morphed into regular banks. Stock market indexes fell. People are increasingly concerned with the financial market, and in this investment climate, a voice that echoes some of Soros’s ideas is quite enlightening. That voice booms forth from The Predator State: “How Conservatives Abandoned the Free Market and Why Liberals Should Too” (Free Press), written by James K. Galbraith, an economist at the University of Texas and son of economist John Kenneth Galbraith, “the last American Institutionalist.”

In Predator State, Galbraith criticizes everything many hold up as the virtues of private markets. He says the Reagan Revolution and all its ensuing years was a fraud. What remains of its swindle? The answer, he says, is nothing: no one save for the academics fall for it anymore.

Galbraith maintains that the Reagan Revolution was based on three presumptions: deregulation, monetarism and low taxes. He says that deregulation is an artifice so that lobbyists can extract “more money from those who can afford to pay – and sometimes from those who cannot.”

Monetarism, in his idea, is a tool to counter labor unions and cope with Wall Street. The conservatives have blind faith in cutting taxes, thinking that it is the only way to save the market. The policy of low taxes did not achieve what it aimed to and failed to stimulate saving Americans. It was only a gift to the wealthiest 1% of the American population.

“It is fair to say that there will never again be any US government for which a truly principled conservative might work,” he says.Galbraith spares no efforts challenging tired conventions. He says inflation rose in the 1970s because the Federal government printed too much money and he laments that big companies, big unions and OPEC have too much pricing power.

As a devoted Keynesian, he says he believes in deficit spending and scoffs at liberals for adopting the ideal of balanced budgets just when the conservatives abandoned it. Those who believe in balanced budgets are not only mimicking conservatives, he says, but are mimicking dead ones. He disagrees with the liberal approach to trade protection, which demands that developing economies agree to reforms in their home countries. It is virtually impossible to do so as “you cannot impose a wage standard on China or Vietnam,” he says. The author endorses such policies as price controls and state planning. “You want higher wages? Raise them. You want more and better jobs? Create them,” he says In his opinion, the market as some exponents advocate does not exist. The market as they describe it, he argues, is but a vaporous idea, a cosmic and ethereal space, a negation and a non-state.

Global depression? What’s for China?

The “d” word is still shunned. But what is the definition? Depends – as usual. Some say, it is a long and severe recession characterized by high unemployment. Others define it based on a 10% fall in output, something that did not happen since the 1930s.

But one thing is clear: it is going to take time and will be painful, as the IMF people already warn (“The worst is yet to come”).

Securitization (in the USA) holds 1.5 trillion US$ of subprime and alt-A loans, 400 billion are delinquent. More are to become delinquent and more foreclosures (of homes) are on the way.

CitiGroup announces staff cuts of over 50,000 worldwide on top of 23,000 earlier layoffs. And so on: financial job losses worldwide are expected to climb from the now 170,000 to over 350,000 by next year – 20% of the total jobs.

It would be naïve to expect China to escape from the domino effect. With exports going down and international companies cutting budgets and people, what can you expect? South East Asia with Japan will also suffer as they supply many of the components used in China’s exports. Logical.

China is not that hungry for a trade surplus. The value-added factor in exports is said to be just 16%, with the other countries like Japan taking a big share. Not to forget the profit companies like Wal-Mart make on their exports from here.

So, China has to focus more on its own needs and market.

China has announced a 4 trillion boost program and a further 1 trillion is already in the pipeline. I totally disagree with Laurence Brahm and others who look at the China infrastructure projects as wasted money, like the Japanese bridges to nowhere. They don’t understand the much needed improvement we need in rail transport, urban transport, water treatment and so on. In recent years, the Ministry of Railways could only satisfy 30% of the demand for passenger and goods transport. Traffic jams in the big cities can only be solved by more public transportation. The electric power network badly needs a better transmission grid to interconnect the separate grids. Everybody knows that. Waste? You must be kidding.

The U.S. better follow China. As Mary Peters, current U.S. transportation secretary said: “The US is one of the few countries in the world to make the majority of its transportation investments without first conducting any kind of economic analysis to determine whether those investments will have any practical benefits for commuters or shippers. The results are telling”.

Indeed, a run-down network of highways and bridges and poor railways and outdated airports. And so much more. Come and learn from China?