I joined the European Chamber Annual Conference 2015: “The Changing Landscape” on 1 December 2015 in the Kempinski Hotel. Many interesting talks and we got some of the presentations. Overall it showed how the economy is changing and the challenges it is bringing.

The program:

Welcome remarks by Jörg Wuttke, President, European Chamber

Keynote Speech by H.E. Hans Dietmar Schweisgut, EU Ambassador to China and Mongolia

Keynote Session with Jin Liqun, President-designate, Asian Infrastructure Investment Bank (AIIB)

Session 1 – Innovation: gateway to sustainable growth

- He Fan, Chief Economist and Managing Director, Caixin

- Denis Depoux, Senior Partner & Asia Deputy President, Roland Berger

- Cyrus Ma, Vice President, SGS

- Maggie Ma, Vice Chairwoman, Greater China, Nokia Corporation

Session 2 – Is China reshaping the global order?

- Peter Weiss, Head of Economic & Finance Section, EU Delegation

- Jurgen Conrad, Head of the Economics Unit, Asian Development Bank

- James Zimmerman, Chairman, AmCham China

Session 3 – China’s middle class and the rebalancing of the Chinese economy

- Jonathan Woetzel, Senior Partner, McKinsey

- Andrew Polk, Senior Economist, The Conference Board

- Zhang Yanqi, General Manager of West and North Region, Uber China

Session 4 – Financial markets: challenges and opportunities ahead

- Alfred Schipke, Senior Resident Representative, IMF

- Logan Wright, Director, Rhodium Group

- Gary Liu, Executive Deputy Director, CEIBS Lujiazui Institute

See some pictures and a few of the slides I found relevant:

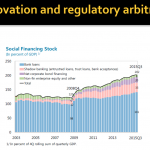

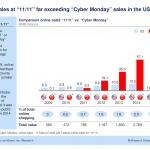

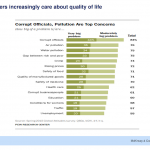

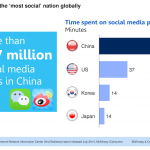

Showing the tremendous impact of modern media and online sales, beating all expectations (the imposing 11/11 sales beating U.S. Cyber Monday); what worries our Chinese friends; debt levels; the SDR issue.

The EU-China Comprehensive Agreement on Investment (CAI) also came up, obviously.

Background: IMF to add yuan to SDR reserve currency basket

The International Monetary Fund has admitted the yuan to the Special Drawing Rights basket of reserve currencies alongside the dollar, euro, yen and pound, Reuters reported. The yuan will have a 10.92% share, in line with expectations, after a review of the weightings formula for the SDR which also cut the euro’s share by more than 6 percentage points. The yuan’s inclusion in the basket from October 2016 is a largely symbolic move with few immediate implications for financial markets. But it is the first time an additional currency has been added to the SDR basket, which determines which currencies countries can receive as part of IMF loans.

The addition will take effect Oct. 1, 2016, with the yuan having a 10.92% weighting in the basket, the IMF said. Weightings will be 41.73% for the dollar, 30.93% for the euro, 8.33% for the yen and 8.09% for the British pound. The dollar currently accounts for 41.9% of the basket, while the euro accounts for 37.4%, the pound 11.3% and the yen 9.4%.

More than six months have passed and with the RMB under pressure the SDR story now looks pretty different. But the challenges remain and did not get better. Not at all.