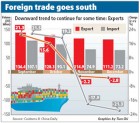

The SCMP reported on 4 March that the mainland’s exports and imports declined further last month after a terrible January.

The trade figures would be weaker than January’s, commerce minister Chen Deming said on the sidelines of a meeting of the Chinese People’s Political Consultative Conference.

Mainland trade with the world took a turn for the worse in January, with exports falling 17.5% year on year to US$ 90.45 billion, much steeper than the 2.8% decline for December. Imports slumped 43.1% to US$51.34 billion, indicating slackening industrial demand.

The magnitude of the declines surprised many economists. Some blamed the drop on fewer working days in January because of the Lunar New Year holiday, which fell in February last year.

On 6 March: SCMP and other media reported that Beijing will run up a record deficit, as Premier Wen Jiabao announced, and he predicted this year would be “the most difficult so far this century”. The government is hoping higher public spending can revive the flagging economy.

Governments at all levels will run a 950 billion yuan deficit this year – seven times more than last year and equal to 3% of 2008 economic output. (not too bad compared to the USA)

“We will significantly increase government spending. This is the most active, direct and efficient way we can expand domestic demand,” Mr. Wen told the 3,000 NPC delegates. Higher public spending would allow the government to aim for economic growth of 8%, he said.

If one looks at the recent charts of the stock markets, we are finally getting at the low levels I was waiting for since months – below the 2002 levels. The concern is that mainland markets are still floating too high in a total disconnect from other main markets. So, fasten your belts.

Now here people start noticing how business slows down, people (many expats) are losing their jobs. Still, people are underestimating the impact of the recession.

The Chinese stimulus plan is still too modest and misses some key industrial segments – the SME. And more needs to be done for education and health care.

Curiously enough, quite a number of the much needed improvements here are similar with the USA – over there infrastructure (road, rail, air traffic, power lines, telecom, etc.), health care and education are also in dire need of improvement. No white elephants, real need to get it all improved.

I agree both the USA and China cannot make the mistake Japan made: not do enough and quickly enough. And avoid the Japanese bridges to nowhere.